Partners

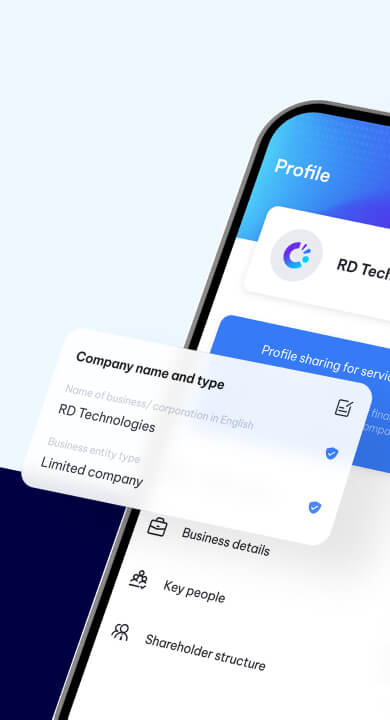

When banks, other financial institutions and business associations,

partner with RD ezLink, not only there can be improvements in customer experience in accessing financial

services well as cost-effectiveness of doing business with SMEs.but they also can continue to meet the KYC

regulatory requirements and help promote financial inclusion.

Why Us?

" SMEs are the cornerstones of Hong Kong's

economy. Given the multiple outbreaks of the pandemic, many SMEs are facing operational difficulties.

Ant Bank (Hong Kong) aims to help these SMEs via our digitalize financial inclusion service to weather

the storm together. Ant Bank believes that the potential partnership with RD ezLink will help SMEs

overcome their cash flow problems and improve our customer services experience through its all-digital

corporate identity verification solution. "

Yvonne Leung

Chief Executive of Ant Bank (Hong Kong) Limited

" We are delighted to be one of the first banks to

be engaged in the new service of RD ezlink. Digitalisation is core to BEA’s business strategy, and we

strive to deploy the latest technologies to enhance customer experience and efficiency. RD ezlink is

making a positive step towards unlocking the potential of automation in eKYC, which we believe will

greatly benefit both SMEs and banks. "

Kelvin Au

General Manager and Head of Corporate Banking

Division of BEA

" The digital corporate identity verification

service to be launched by RD ezLink will make it easier for banks to obtain verified company

information and business data, resulting in less time and manual effort required on customer due

diligence processes. We are looking forward to an indepth cooperation with RD ezLink Limited in order

to provide the best customer experience and quality financial services for CMB Wing Lung Bank

customers. "

He Xin

Deputy General Manager of CMB Wing Lung Bank

" Standard Chartered is dedicated to providing more

secure and more convenient banking services for its clients through digitization. We are pleased to

have reached a preliminary agreement with RD ezLink to explore the use of Fintech and Regtech to

strengthen the financial services for SME clients, improve the efficiency of the customer due

diligence processes, and maintain prudent risk management. "

Winnie Tung

Head of Business Banking at Standard Chartered Hong

Kong